[ad_1]

A new Mobiquity report revealed the areas in which applications can be elevated to avoid customer loss.

Digital offerings such as insurance apps play a key role in customer retention, and a recent report from Mobiquity has identified the areas in which these applications must improve.

People don’t use their insurer’s application every day, so the limited usage time must perform.

Customers who are willing to switch to another company can be convinced to stay with the right digital offerings. Equally, having insurance apps that exceed those of a rival insurer can help to draw their customers who are looking to switch.

That said, these applications need to tick all the boxes both effectively and efficiently. According to the Mobiquity report, this will help to encourage customers to use the app more frequently than they usually would and can also help to encourage them to stay.

Applications are used for very specific reasons, such as to check a policy’s details or to pay a bill once per month. Moreover, customers who have an autopayment or longer payment schedule will use it even less. Therefore, offering an exceptionally convenient and useful experience is critically important for making a positive impression on customers in that very small amount of time.

Insurance apps with features such as biometric login and push notifications boost appeal.

Apps with simple features help to appeal to customers who will see them as a reason to stay when they would otherwise have looked elsewhere. Biometric logins help to make it considerably easier to log in. Push notifications with important reminders about when bills are due or when updates are required. These types of feature help to ensure customers feel a positive relationship with their insurers and don’t feel the inclination to change things.

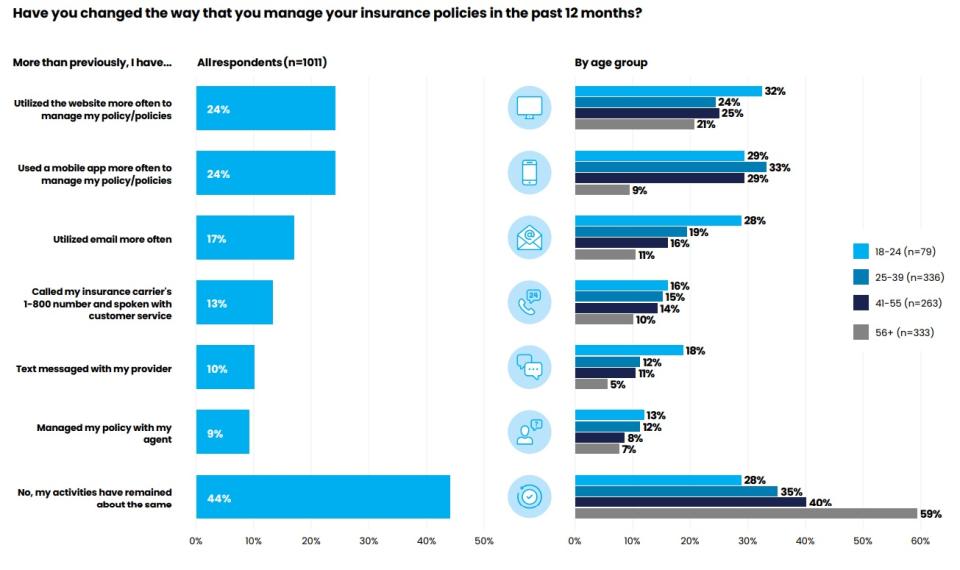

Mobiquity, a digital consultancy, cited a recent data study that indicated that 38 percent of insurance customers agree that they would be less likely to change insurers once they have downloaded that provider’s app. Among customers over the age of 18 years, 30 percent said that they would switch to another provider if the change would get them better digital features.

Insurance companies know the importance of their apps but may not know how to optimize.

Insurance companies are aware of this trend and have been working to reinvent their digital platforms and rebuild their insurance apps in order to keep up. That said, it isn’t just a matter of changing things or adding new features. Instead, it is important to keep certain key features that keep current customers satisfied and build other features that customers expect or that would help the app to stand out in app stores, said the Mobiquity report.

The report pointed to Mobiquity’s analysis of the insurance apps from Allstate, AmFam, Farmers, Geico, Liberty Mutual, Progressive, State Farm, and The General. This included an examination of user reviews and the types of features most frequently mentioned in both positive and negative contexts. The report showed that a seamless mobile app experience was highly important.

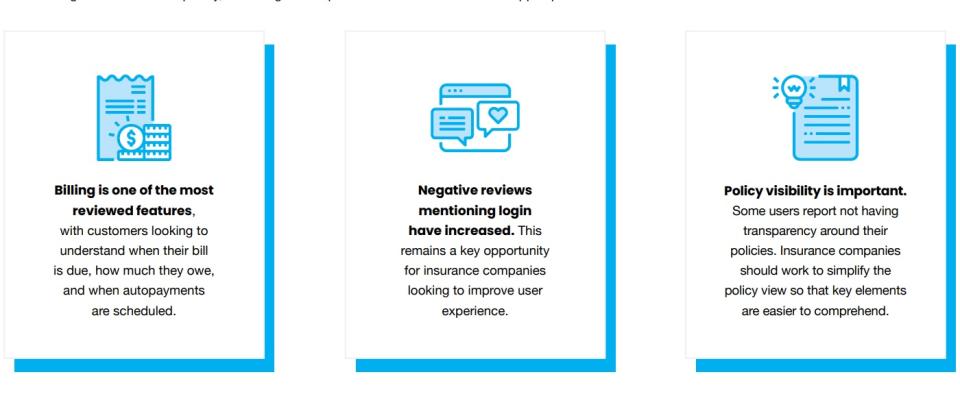

Among the most reviewed insurance app features was billing. Customers wanted to quickly and easily know exactly how much they owe, when the bill is due, and when their autopayments are scheduled to be made.

Negative reviews have increasingly mentioned login experiences. The app login is seen as a primary opportunity to improve the user experience. Security and convenience are both important factors in that light, and features such as biometrics can provide a sense of both.

Policy visibility was also seen as highly desirable in insurance apps. Some users were dissatisfied with a lack of policy transparency in their apps. Therefore, insurers  who want to appeal to their customers through their digital offerings will want to look to simplification of the policy view to make key elements easier to understand. This type of focus on streamlined simplicity can make all the difference in existing policyholder retention and appeal to new customers

who want to appeal to their customers through their digital offerings will want to look to simplification of the policy view to make key elements easier to understand. This type of focus on streamlined simplicity can make all the difference in existing policyholder retention and appeal to new customers

[ad_2]

Source link