[ad_1]

From luxury to necessity, working from home now benefits the world. But it comes at a cost, and for WFH employees the unexpected financial toll can be stressful. On the upside, companies can support every employee with a home office stipend. These creative employee incentives can strengthen your team and improve productivity. Read on for all the details on home office stipends!

Home Office Stipend 101

Although the work environment is shifting from corporate buildings into homes, the need for an office space remains. That’s where a remote work stipend comes in – but what’s it all about? Let’s find out by tackling the most pressing questions.

What are Home Office Stipends?

Modern work from home office set up by Decorilla interior designer, Breanna W.

Simply put, a home office stipend is an allowance paid to employees to improve their home office or workspace. It can go towards buying office furniture, equipment, like a laptop, or a better internet connection – anything that streamlines the workday so it looks and feels like an office. Furthermore, the stipend is separate from a salary and can be provided as a once-off or ongoing basis, i.e. monthly or yearly.

Looking to add home office setup as part of your employee’s work from home stipend? Then schedule a Free Interior Design Consultation to learn more today!

What is the Cost of Working from Home?

Decorilla interior design as a home office stipend results by interior designer, Joyce T.

People working from home need a beautiful home office background for virtual meetings but they also need a productive home office, which isn’t always the case. For this reason, the accrued cost can certainly be hefty. But what does it cost to work from home? That depends on the utilities and how the employee generally spends their working day. Internet, telephone bills, printers, lights, air-conditioning, home office furniture, and office supplies are among the factors that increase the cost of working from home.

Should Employees be Reimbursed for Working from Home?

An employer is not necessarily obligated to pay a home office stipend. But in some cases, they are responsible for reimbursement of the business use of employees’ assets. More specifically,

- When the employee is on-or-near minimum wage. According to the federal Fair Labor Standards Act, an employee must earn at least the minimum wage above business costs incurred while doing their job.

- Some states, like California, Washington, and Iowa, require companies to reimburse employees for all essential business expenses.

- If not reimbursing an employee leads to an employer being unjustly enriched.

Are Home Office Stipends Taxable?

Mid-century modern home office as a creative employee incentive by Decorilla designer, Lila N.

A home office stipend can be tax-free. However, if they aren’t separated from an employee’s income, they will be taxed. Moreover, the employer and employee could lose a third of the stipend as a result. For tax-free reimbursements on a productive home office, validate and file the expenditure under one of two categories.

1. Tax-Free Employee Benefit

Work-related expenses, like creating a work from home office set up, can fall under a home office tax deduction. An employee can be fully compensated for purchasing home office furniture or equipment as well as the maintenance costs for that section of their home.

To qualify, an employee must:

- Use a part (either a room or a section) of their home for their employer’s benefit, regularly and exclusively.

- Timely submit an accountable plan. This includes recording expenses, keeping to substantiation rules, and giving the report and receipts to the employer.

2. Qualified Disaster Relief Payments

An alternative temporary solution is reimbursements as qualified disaster relief payments. Under this provision, reasonable and necessary employee expenses incurred during a national emergency (like the coronavirus pandemic) can be paid tax-free. Purchases for setting up a productive home office fully equipped with internet services and other necessities can all be compensated without an accountable plan.

Examples of a Home Office Stipend

Not only can home office allowances assist employees in creating a work from home set up, but it can also encourage team efficiency. Among the many creative employee incentives for working remotely, home office design and a general allowance provide the best start.

1. Home Office Interior Design as a Creative Employee Incentive

Eclectic design with modern home office furniture by Decorilla designer, Farzaneh K.

Companies could put a remote work allowance to good use with home office interior design. Online interior design services, like Decorilla, combine traditional interior design with the convenience and safety of technology to provide people with practical, ergonomic, and lovely livable spaces. With a corporate solution unlike any other, employers can provide employees with a complete work from home office set up at a reduced cost.

Advantages of Online Home Office Interior Design

Complete WFH setup as home office stipend by Decorilla interior designer, Drew F.

Online interior design can benefit both the employer and employee. First, by providing a work from home set up quickly and professionally and, secondly, by saving costs through furniture discounts and eliminating unnecessary purchases. With home office design, the team receives:

- A shortened wait period for setting up a home office space.

- Professional interior designers who will choose the layout and furniture best suited to the employee’s space.

- 3D renderings of what the home office will look like.

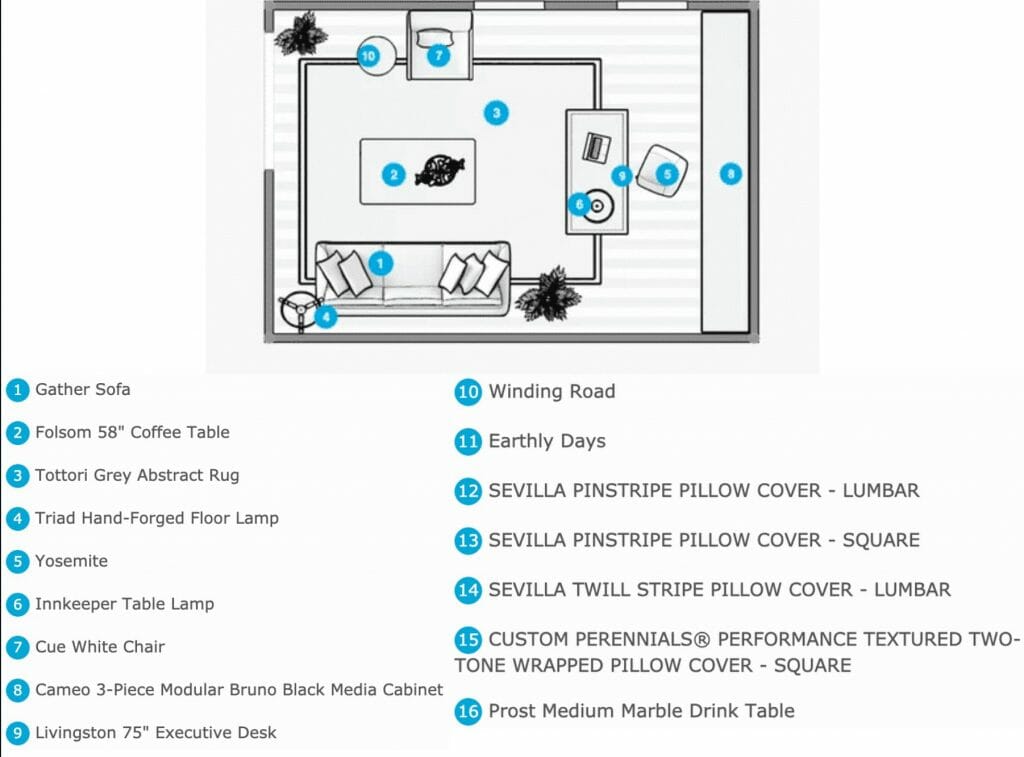

- A detailed shopping list with store links and exclusive home office furniture discounts that can amount to more than the cost of the design. All furniture sizes and specifications are included in the list.

- A color palette that complements the employee’s home design.

- Designer tips and guidance for implementing the design at home.

Home office stipend design package – moodboard by Decorilla designer, Drew F.

Moodboard for a Decorilla corporate solutions home office interior design package

Decorilla shopping list complete with exclusive discounts

Decorilla 3D Rendering – Work From Home Set Up

Having a work from home office set up completely designed for them, employers can rest assured that their employees will have a productive environment personally suited to them. Furthermore, the designs can work within the allotted space each employee has for working from home. As a result, this corporate solution takes the guesswork out of achieving a productive home office set up.

2. General Remote Work Stipend

Masculine work from home office set up by Decorilla designer, Fares N.

When the employee needs vary from day to day, a general home office allowance is a good way to cover those expenses. However, companies can get creative with their employee incentives by crafting different perk packages. According to three Compt case studies, partially- to fully-remote companies provide the following home office stipends for their team:

Fully remote employees receive an allowance of up to $250/month, while coworking members receive between $100-200/month. One company provides $500 per team member to create a work from home set up, as well as $200/year for tech needs.

Each company provides all its employees with an annual education allowance of $850-1,000.

Some businesses give stipends to encourage employees to take care of their wellbeing. For example, these allowances range from $100-200/month and go toward fitness, general health and wellness – even massages.

How Companies Are Helping Employees Work from Home

Sleek work from home office set up by Decorilla designer, Mladen C.

Companies that offer home office allowances give their employees a chance to be as – or more – productive than they were in the office. It’s no secret that a beautiful environment can do wonders for the human mind. And with a little help (or creative employee incentives), a nook or study room can become a productive home office.

What Home Office Expenses do Employers Cover?

To ensure their team is working comfortably and productively from home, companies cover a range of reasonable employee expenses. Which costs to cover will vary from one company to the next. Fortunately, employers can tailor a home office stipend package to suit their team.

Typical home office expenses include:

- Devices and Services: Internet and modem fee, mobile or landline device costs, data, carrier costs, and insurance.

- Home Office Furniture: Comfortable and ergonomic home office furniture for a work from home office set up.

- Software and Hardware: Tablet or laptop, webcams, headset, and communication software, like Zoom or Slack.

- Coworking Pass: Sometimes a remote work stipend goes beyond the home sphere and into shared spaces. Coworking offices are one such option.

- Regional Costs: Maintenance of the home office, which can include electricity and mortgage of that portion of an employee’s home.

Benefits of a Home Office Stipend

Not only do these creative employee incentives ease WFH expenses, but they also promote company culture, values, and attract exceptional talent to join the team.

7 Home Office Allowance Advantages

Minimal productive home office by Decorilla designer, Ajita T.

1. Improved Tax Management

With continual bookkeeping of expenses, it’ll be easier to account for company expenditures and taxes.

2. Employee-Centered Benefit

As employees are in charge of spending their home office stipend responsively, they can purchase things they’ll actually use. In this sense, the benefit base is broader than it would be in an office. Moreover, they will have to spend the money mindfully to truly benefit their work from home set up.

3. Flexibility & Convenience

Once employees receive their allowances, they can get what they need when they need it without a processing delay. With such aid, they can improve any part of their work-life, whenever.

4. Efficiency Boost

By placing the onus on the WFH employees, some administrative functions fall away, like those on HR. As a result, this means some managing software will become redundant.

5. Less Waste

Sometimes traditional perks offered in conventional offices go unused and lead to wasted budget and time. With a work from home stipend, companies can use valuable resources and capital mindfully instead of on a one-size-fits-all benefit.

6. Strategic Alignment with Company Values

Employers can adapt their home office allowance packages to strengthen company values and culture. Continual learning or wellness stipends, for instance, are among the top ways to support your brand remotely.

7. Improved Morale & Connections

Creative employee incentives, like remote work stipends, can strengthen the employer-team connection. Working from home can be lonely, but acknowledging employee needs can give them a sense of belonging. In turn, this can certainly lead to increased productivity, motivation, and engagement.

How to Set Up a Remote Work Allowance at Your Company

To set up a work from home stipend, companies can follow the following procedure:

- Select how you want to attribute a home office stipend: as a once-off advance, monthly or yearly allowance, or in productive home office design.

- Establish what an allowance must cover and how much to reimburse. A home office stipend can fund anything from internet services to home office furniture. Communicate with employees accordingly and consider what the office environment should incorporate.

- Categorize home office stipends for tax. They will either fall under an employee benefit or disaster relief payments.

- Explain the process clearly to employees. For tax purposes, beneficiaries of an allowance need to follow the correct procedure, e.g. recording expenses and filing receipts. Not only this, but employees must have a clear outline of what their home office stipend goes toward and its limitations.

- Engage with employees and review feedback. With valuable input, employers can assess whether they need to adjust the remote work stipend or not.

Looking for a creative employee incentive and like the idea home office design for your WFH team? Then Schedule a Free Interior Design Consultation with to learn more today!

[images: 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25]

[ad_2]

Source link