[ad_1]

Last Updated on July 17, 2022 by Kristi Linauer

[Note: This post was updated on 7/17/2022 with a lot more information because I was clearly not getting my point across in the original post. Hopefully my points are clearer now.]

It’s been many years now since Chip & Joanna Gaines have become household names due to their hugely successful and popular TV show Fixer Upper on HGTV. And since then, their business empire in Waco (the city where I was born, and where I’ve lived about 45 of my 49 years of life) has grown from a TV show, to a huge retail store, bakery, restaurant, bed and breakfasts, a real estate company, a media network, and now a restored “castle” that is (or will soon be) open for tours.

Their impact on Waco can’t be missed. Waco has gone from a sleepy little town that most people miss if they blink while driving through on their way up I-35 traveling from Austin to Dallas, to an actual tourist attraction, and a tourist attraction for positive reasons (unlike that decade post-1993, if you know what I mean).

But if you talk to the average Wacoan — those who just live here and live normal lives here — a large portion of them are getting a bit burned out on all things Magnolia. I hear it when I talk to people around town. I see it when I read comments on articles from the local media. Many have been feeling for a long time that it’s just enough.

In the beginning, everyone enjoyed the positive press that Waco was finally getting. But when things finally started affecting the real lives of real Wacoans, and in ways that weren’t so helpful, the feelings started to turn. And that’s where a lot of Wacoans find themselves today.

To show you what I mean, I’ll show you this example that I came across just this week.

If you’ll remember, the premise of the Fixer Upper show was, as Chip stated in the intro of every show, “We take the worst house in the best neighborhood and turn it into our client’s dream home.”

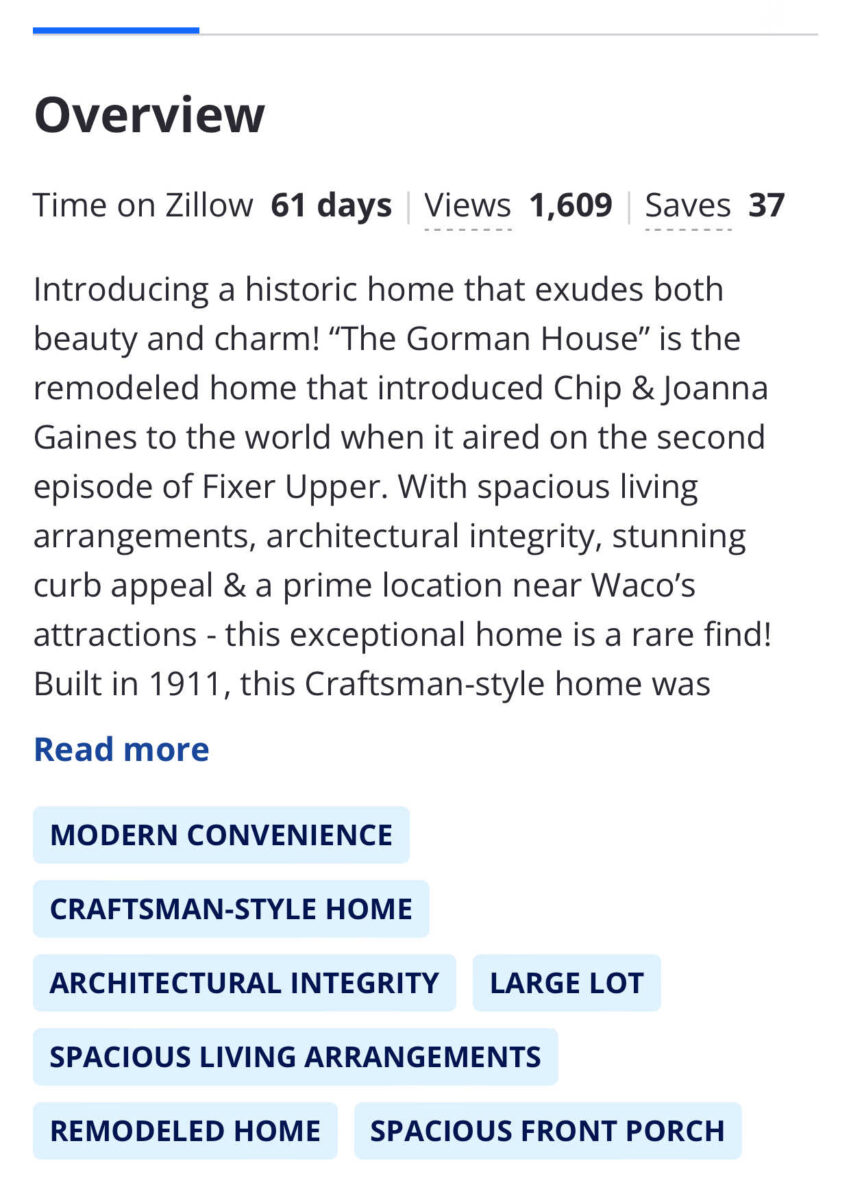

Well, many of you may remember The Gorman House, which was featured during the first season of Fixer Upper. That house is on the market right now for $1.2 million. Here are some pictures from the Zillow listing:

You can see a lot more pictures on the listing here.

It truly is a beautiful house, and they did a great job remodeling it. The problem is that price. $1.2 million…in that neighborhood.

I don’t know how property taxes work in other states. But here, property taxes are directly correlated to the assessed value of the house, which is determined largely by the value of the other houses in the neighborhood.

So if the current owner of this house managed to actually sell this house for $1.2 million, that will then affect the value of the other houses in the area, which means that those homeowners will then have their property taxes increased. All because of this house.

It’s the very same issue I have with the awful flip house next door to us (which still hasn’t sold, by the way). We bought our house almost nine years ago for $80,000, and since then, our house has gone up in assessed value every year, which means we pay more property taxes each year.

But if that house next door to us had actually sold for the original (and insane) asking price of $450,000, that would have artificially driven up the assessed value of our house right next door, which means that our property taxes (and all my our neighbors’ property taxes) would have taken a huge jump the next year all because of that one house.

So that brings us back to The Gorman House. Of course, the current owners can ask whatever they want for the house. They could ask $4 million for that house. It won’t really matter until someone actually buys it. But the very fact that someone feels like they can actually put that $1.2 million price tag on that house is directly related to the fact that Chip and Joanna’s names (and the Fixer Upper name) are attached to that house.

To be clear, Chip and Joanna don’t own the house, and they’re not the ones selling it. But the fact that it is a Fixer Upper house is being used to market the house. That info is used to market all of these Fixer Upper houses that go on the market. And so far, all of them that I’ve seen hit the market at prices that are much higher (sometimes by many multiples) than the values of the other houses in the neighborhood.

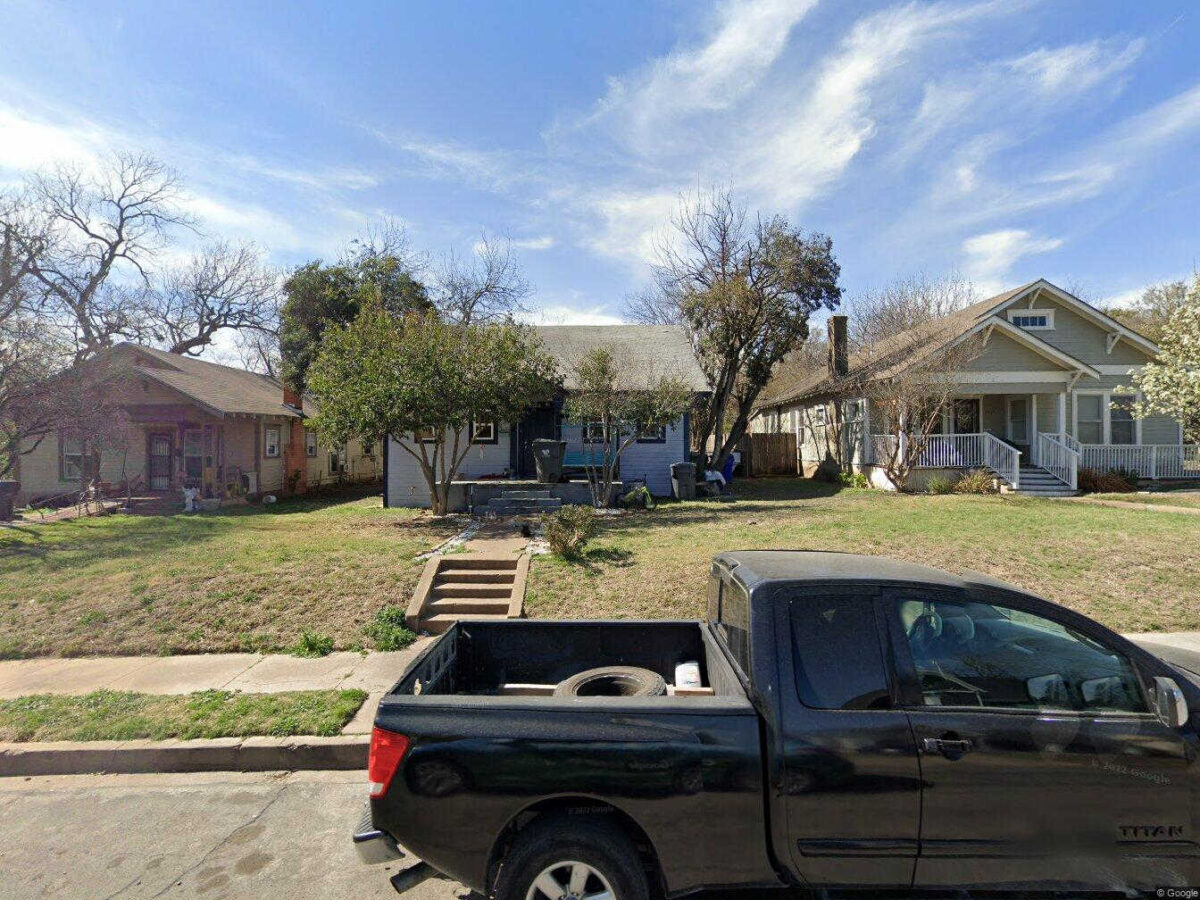

So let me show you pictures of the neighborhood, and you can decide for yourself if they remodeled the worst house in the best neighborhood. Here are some of the houses just down from The Gorman House on the same side of the street. (These are all public, so I’m not violated anyone’s privacy.)

Here’s the house directly across from The Gorman House.

And here’s one more directly across from The Gorman House.

So you can tell me if you think they remodeled the worst house (a massive 7 bedroom 7 bathroom house surrounded by modest-sized houses) in the best neighborhood. Here’s a quick look at the current home values in that area…

No. The answer is no. In no way would this qualify as a “best neighborhood”. Those estimated values are current. Years ago, when the Gorman House was remodeled for the show (which I believe was around 2016), these houses were probably more in the $80,000 range. Now the average price looks to be around $150,000, but there’s nothing even remotely close to $1.2 million in that area. So if that house sells for $1.2 million, or even a $1 million, or even $700,000, I can’t imagine what will happen to the people who live in that neighborhood. That sale will drive up the assessed values of the homes around it, which in turn will drive up the property taxes of all the houses around it.

And again, the only reason someone would think they could even ask that much for that house is because of the association with Fixer Upper. I know prices and taxes have spun out of control since the beginning of 2020, but what I’m talking about here is something very different altogether, and it’s a problem that’s been happening around Waco since around 2016.

The tax records are public, and you can see the taxes on the Gorman House over the years. In 2016, the tax assessment value of that house was $168,500, and the taxes were $3,742. Two years later, the house was assessed at $331,000, and the taxes were $9,312.

During that same time period, the house pictured below (you can see the Gorman House on the far right) went from a tax assessment value of $51,130 to $109,320, and the taxes more than doubled, going from $1,439 to $3,076.

And during that same time, the little red house with the flagpole in the front (three pictures above) went from an assessed value of $31,260 with taxes of $830, to an assessed value of $57,700 and taxes of $1,623. I don’t presume to know the financial situations of the people living in these homes, but based on the looks of the homes, I also wouldn’t presume that they have wiggle room in their budgets for their property taxes to double from one year to the next.

Again, this seems to be happening in every neighborhood where there’s a Fixer Upper house. This isn’t a new problem associated with the explosion in real estate prices over the last 2.5 years. This dates back further to 2015 and 2016.

So if the current owners do manage to sell the Gorman House for $1.2 million, or even $1 million, or even $700,000, it will just compound the current real estate and tax problem that we’ve seen spin out of control over the last 2.5 years.

The same thing happened to the Fixer Upper house in my mom’s neighborhood. Once they got their hands on that house and remodeled it, the price tag skyrocketed. The houses in that area, if I had to guess, were probably valued at around $285,000 and under at that time back in 2016. And if my memory serves me correctly, I’m pretty sure when that Fixer Upper house was listed for sale the last time, those owners put an insane $700,000 price tag on it. I remember being absolutely stunned at the asking price. I mean, I laughed at it. I scoffed. And the ONLY reason someone would think that they could get that price for that house is because they knew they could market it as a “Fixer Upper” house.

I was right, thank goodness. The house didn’t sell for that price, but it did sell for a MUCH higher price than what all of the other houses in that area were valued at. And since then, the property taxes on that house have gone from $1800/year to $7200/year, which in turn, seems to have had an effect on the assessed values and property taxes of many of the other houses in that neighborhood.

There are some neighborhoods that can handle the improvements. My mom’s neighborhood is one of them. She lives in an older, well-established neighborhood of a very sought-after suburb of Waco. It’s that kind of area where Chip and Joanna can ACTUALLY go in and remodel “the worst house in the best neighborhood and turn it into our client’s dream home” and benefit the whole neighborhood. But there are some neighborhoods that just simply can’t afford it, and, in my humble opinion, should just be left alone.

The Shotgun House is another prime example. I’ll never forget the day I found the address of the Shotgun House and decided to take a drive across town to see it myself. This was many years ago, soon after they had finished that house, and when I turned onto the street, I couldn’t believe what I was seeing. In absolutely no universe could that have been called “the best neighborhood”. Honestly, I could only wonder if some of those houses had electricity and running water.

It was like I had been transported into a poverty-stricken town in the Appalachian Mountains. I thought for sure that I had made a wrong turn, but I kept on driving, and there towards the end of the street on the left hand side stood the sparkling new and beautiful Shotgun House.

Again, I was stunned. I couldn’t imagine investing so much money (or any, really) in real estate in that area. And then to sell the premise of that show as them taking “the worst house in the best neighborhood and turn[ing] it into our client’s dream home”? Again, in no universe could that describe what they had done.

So imagine my utter and complete shock when the owner tried to sell that house for $950,000, and again, the ONLY reason anyone would ever think they’d get that much for that house is because of the association with Fixer Upper. I don’t think it ever sold (at least there’s no record of it on Zillow), but the assessed value of that house is now $183,300, and the taxes are $3,895.

While that doesn’t sound too outrageous, you would have to compare it to the houses around it at the time to understand the effect. One of the houses on that street (one of them that’s still standing) was assessed at $40,940 during 2014-2016, with taxes of $1,163. And then in 2017, the assessed value of the house and the taxes both increased 115% to $88,100 and $2,504 respectively.

That same trend seems to be true for all of the other houses that are still standing on that street when you look at the records during that same time period. I haven’t been over there since then, but I have looked on Google Maps and Zillow to see what’s going on in that part of town. From what I can tell on Google Maps, a lot of those houses that I saw years ago when I drove over there don’t appear to still be standing today.

It looks like some of them were torn down so that apartments and other investment properties could be built. And again, I can’t help but wonder if that happened because those people could no longer afford to stay in their homes when their assessed value and their property taxes more than doubled from one year to the next. So in came the investors to take advantage of the situation.

Anyway, that’s the story of Waco that doesn’t get told very much. I have to admit that as a native Wacoan, I’m kind of on the “burned out” end of the spectrum. Every time Chip and Joanna buy another property and announce another business, I just want to say, “When will it be enough?”

And every time I see a Fixer Upper rerun and hear Chip say, “We take the worst house in the best neighborhood and turn it into our client’s dream home,” I wonder if the viewing audience actually believes that. While it may be true some of the time, it most assuredly is not true for every episode. And when they remodel the biggest house in a low income neighborhood, it sets off a chain reaction of events that isn’t always such a blessing for those who live there.

On a personal note, I did personally get upset when they took a Waco landmark — the Waco Elite Cafe — that has been a Waco icon for decades, and where Elvis Presley ate when he was stationed at Ft. Hood, and gutted the place, drenched it in their “farmhouse” look, and put their brand name on it. That didn’t set well with me at all. It didn’t set well with a lot of Wacoans.

And it upsets me now that they’ve redone another Waco landmark — an historic “castle” that was built in 1890 — and have remodeled it and are going to charge $50 per person for tours. I mean, I don’t know of a nicer way to say it, but that just seems greedy to me. Heck, you can buy a ticket to tour the Biltmore Estate for $89, so paying $50 for a home tour in Waco, Texas, just seems ridiculous to me. (They’ve already said they plan to sell it, so they’ll recoup their investment in the sale.) I’ll admit that I’m incredibly disappointed by their decision to charge that much to tour this Waco landmark, especially when such a price tag will be too much for a huge percentage of Wacoans to pay. Yes, tourists will pay it. But a huge portion of the very people who live here won’t be able to afford it. And I swear, if I were to walk into that Waco landmark and see shiplap on any of those walls, I’d probably lose my mind. ?

Anyway, that’s the downside to having the Magnolia empire take over your city. To be clear, I don’t dislike Chip and Joanna. I don’t know them. I’ve met Joanna and talked with her on a few occasions (all before their Fixer Upper fame), and she was perfectly nice. I don’t have anything against them on a personal level. But when I saw that Gorman House listing a few days ago, and saw the asking price (and again, they are not the ones selling it, but that price is directly influenced by their previous involvement in it), and having just seen the local newspaper article announcing the $50-per-person tours of another Magnolia-branded Waco landmark, I did let out an exasperated sigh once again, and think to myself, “When is enough going to be enough?”

And while I won’t be watching their reboot of Fixer Upper on their new network, I do hope they’ll be more mindful when choosing the homes they remodel. If they’re selling the show as “tak[ing] the worst house in the best neighborhood and turn[ing] it into our client’s dream home,” I hope they’ll actually do that.

Addicted 2 Decorating is where I share my DIY and decorating journey as I remodel and decorate the 1948 fixer upper that my husband, Matt, and I bought in 2013. Matt has M.S. and is unable to do physical work, so I do the majority of the work on the house by myself. You can learn more about me here.

I hope you’ll join me on my DIY and decorating journey! If you want to follow my projects and progress, you can subscribe below and have each new post delivered to your email inbox. That way you’ll never miss a thing!

[ad_2]

Source link