[ad_1]

By Max Dorfman, Research Writer, Triple-I

2023 was another year with high-risk climate and weather-related challenges, with 2024 positioned to pose its own challenges.

Indeed, 2023 was the warmest year for the globe since 1850 — when these records were first made. The temperature in 2023 was over two degrees Celsius above the 20th Century average, with the 10 warmest years in recorded history occurring from 2014-2023. Record-setting temperatures hit areas across Canada, the southern United States, Central America, South America, Africa, Europe, Asia, as well as parts of the Atlantic Ocean, the Indian Ocean, and South Pacific Ocean.

These shifts in global weather – combined with changing population and other dynamics – have played a powerful role in the risk of disasters.

Costs are high

In the United States, Allianz estimates, extreme weather events now cost the country $150 billion a year, making these perils “key threats” for organizations. However, larger companies are leading a response to these risks by transforming their business models to low carbon, while also creating new and improved plans to respond to climate events. Allianz notes that supply-chain resilience is a crucial area of focus for the coming year.

“Although this year’s Allianz Risk Barometer results on climate change show that reputational, reporting, and legal risks are regarded as lesser threats by businesses,” said Denise De Bilio, ESG Director, Risk Consulting, Allianz Commercial, “many of these challenges are interlinked.”

According to Allianz, exposure remains highest for utility, energy, and industrial sectors. Last year’s wildfires in Canada limited oil and gas output to 3.7 percent of national production. Water scarcity is now also considered to be a threat.

Promising developments

As Triple-I reported in late 2023, despite all the concern regarding climate risk, certain weather-related disasters actually declined in the past year. This includes U.S. wildfire, which saw its lowest frequency and severity in the past two decades, despite catastrophic losses in Washington State, Hawaii, Louisiana, and elsewhere, according to a Triple-I Issues Brief. California – a state often considered synonymous with wildfire – last year experienced its third mild fire season in a row.

Homeowners insurance rates in California, as elsewhere in the United States, have been rising. Some of this trend is due to wildfires and construction in the wildland-urban interface, which put increased amounts of expensive property at risk. According to Cal Fire, five of the largest wildfires in the state’s history have occurred since 2017.

Much of California’s problem, however, is related to a 1988 measure – Proposition 103 – that severely constrains insurers’ ability to profitably insure property in the state. Late in 2023, California Insurance Commissioner Ricardo Lara announced a package of executive actions aimed at addressing some of the challenges included in Proposition 103.

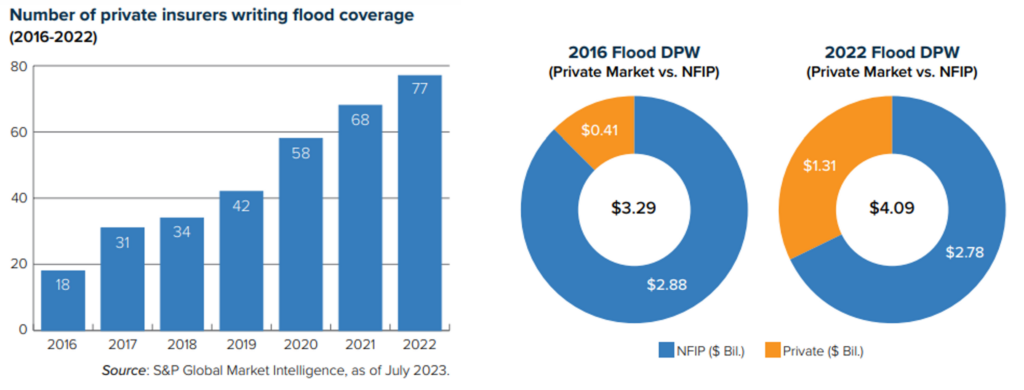

Flood remains a severe and increasing peril in the United States. While the federal government remains the main source of insurance coverage through FEMA’s National Flood Insurance Program (NFIP), the private insurance market is increasingly stepping up to assume more of the risk. As Triple-I has reported, between 2016 and 2022, the total flood market grew 24 percent – from $3.29 billion in direct premiums written to $4.09 billion – with 77 private companies writing 32.1 percent of the business. As the charts below make clear, private insurers are accounting for a bigger piece of a growing pie.

This is an important development, as the growing private-sector involvement in flood can reasonably be expected to result, over time, in greater availability and affordability of flood insurance as the peril increases and NFIP – through increased reliance on risk-based pricing – spreads the cost of coverage more fairly among property owners. Historically, the system often subsidized coverage for higher-risk homes, to the detriment of lower-risk property owners. With NFIP premium rates rising to more accurately reflect the risk assumed, private insurers – armed with increasingly sophisticated data and analytical tools – are better equipped than ever to identify opportunities to write more business.

Much yet to be done

Growing awareness and action to address climate-related risk is promising, but the crisis is far from over. In several U.S. states, insurance affordability and even availability are being affected, and much of the conversation around this topic confuses cause with effect. Rising insurance rates and constrained underwriting capacity is a result of the risk environment – not a cause of it.

Investment in mitigation and resilience is necessary, and this will require collective responsibility from the individual and community levels up through all levels of government. It will require public-private partnerships and appropriate alignment of investment incentives for all co-beneficiaries.

Learn More:

Triple-I Issues Brief: Flood

Triple-I Issues Brief: Wildfire

FEMA Reauthorization Session Highlights Importance of Risk Transfer and Reduction

Miami-Dade, Fla., Sees Flood Insurance Rate Cuts, Thanks to Resilience Investment

Milwaukee District Eyes Expanding Nature-Based Flood-Mitigation Plan

Attacking the Risk Crisis: Roadmap to Investment in Flood Resilience

It’s Not an “Insurance Crisis” — It’s a Risk Crisis

[ad_2]

Source link