[ad_1]

Property owners in Lee County, Fla., could lose their flood insurance premium discounts under the National Flood Insurance Program (NFIP) Community Rating System (CRS), according to a recent announcement by FEMA.

CRS is a voluntary program that recognizes and encourages community floodplain management practices that exceed NFIP minimum requirements. Over 1,500 communities participate nationwide.

FEMA informed leaders in the affected communities – which include Cape Coral, Bonita Springs, Estero, Fort Myers Beach, and unincorporated Lee County – that they would begin losing their discounts starting October 1. Under CRS, these communities currently receive discounts of up to 25 percent. Unincorporated Lee County and the City of Cape Coral get the biggest benefit due to their Class 5 ratings. Rates will increase by approximately $300 annually for the 115,000 homeowners impacted by FEMA’s decision.

“This retrograde is due to the large amount of unpermitted work, lack of documentation, and failure to properly monitor activity in special flood hazard areas, including substantial damage compliance,” FEMA said in a statement.

FEMA officials told the Miami Herald that the problems began shortly after Hurricane Ian in 2022, when federal teams visited the communities hit the hardest and looked at the properties they thought were most likely to be substantially damaged, including older homes built in flood zones, some with previous flood damage.

“What the team found, unfortunately, is there was a lot of unpermitted work, lack of documentation,” said Robert Samaan, the regional administrator for FEMA’s Region 4, including Florida. “It was just a failure to properly monitor the activity in the special flood hazard area.”

FEMA shared with the Herald three letters it sent Lee County in 2023 — one in February, one in June and one in December — asking for information on the number of damaged homes and warning that not providing the information could result in the county losing its flood insurance discounts.

In recent months, a number of Florida communities, including Miami-Dade County, have benefited from lower flood insurance premiums as a result of improved CRS scores that reflect resilience-related investment. CRS has become particularly beneficial as NFIP pricing reforms – known as Risk Rating 2.0 –that more closely align premium rates with property-specific risks – have contributed to rising premiums for some property owners. Before these reforms, it was not uncommon for lower-risk owners to be subsidizing higher-risk ones through their premium rates.

Rising NFIP rates have been accompanied by another trend: increased involvement by private insurers in the flood insurance market.

“Florida has the most robust private flood insurance market in the United States, which provides consumers with numerous options for coverage,” said Mark Friedlander, director of corporate communications for Triple-I. “Nearly a third of Florida flood policies are written by private carriers, and many private flood insurers offer better pricing and more robust policies than NFIP. It’s worth taking the time to shop for coverage and obtain multiple quotes.”

As recently as 2018, private insurers provided only 3 percent of flood coverage in Florida.

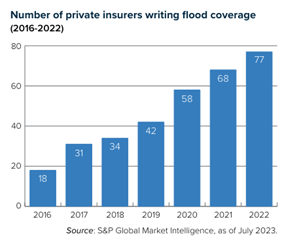

This growth mirrors a national trend. Between 2016 and 2022 the total flood market grew 24 percent – from $3.29 billion in direct premiums written to $4.09 billion – with 77 private companies writing 32.1 percent of the business, up from 18 companies writing 12.5 percent. Private insurers are accounting for a bigger piece of a growing pie.

Florida’s Office of Insurance Regulation has heavily promoted the availability of private flood insurance in the state over the past several years, and many private flood insurers are domiciled in the state, Friedlander said.

“We are committed to helping these communities take appropriate remediation actions to participate in the Community Rating System again and work towards future policy discounts,” FEMA said in its statement.

Earlier this year, Sea Isle City, N.J., had its Class 3 rating restored after a brief demotion in 2023. Sea Isle City and Avalon are the only towns in the state to have Class 3 ratings.

Learn More:

Coastal New Jersey Town Regains Class 3 NFIP Rating

FEMA Reauthorization Session Highlights Importance of Risk Transfer and Reduction

Miami-Dade, Fla., Sees Flood Insurance Rate Cuts Thanks to Resilience Investment, Thanks to Resilience Investment

Attacking the Risk Crisis: Roadmap to Investment in Flood Resilience

Triple-I “State of the Risk” Issues Brief: Flood

[ad_2]

Source link