[ad_1]

South Carolina’s liquor liability insurance market is in crisis, with insurers losing an average of $1.77 for every $1.00 of premium earned since 2017, while claim frequencies significantly outpace neighboring states, according to a recent study by the state’s Department of Insurance.

The comprehensive analysis, initiated following a 2019 request by the South Carolina Senate Judiciary Committee, reveals a deeply troubled marketplace where insurers are losing money.

“The data seem to confirm the anecdotal assertions, made by both insurance companies and small businesses, of a very troubled and challenged marketplace,” the report stated.

Current Market Landscape

The liquor liability insurance market in South Carolina has maintained a relatively stable number of participants in recent years. Since 2019, the number of insurance groups operating in this sector has held steady at around 48 participants. This consistency in market players suggests a mature, albeit challenging, insurance environment.

Despite the overall stability in participant numbers, the market is characterized by the dominance of three major insurance groups.

Premium Trends

While the number of market participants has remained relatively constant, earned premiums have experienced remarkable growth over a five-year period. From 2017 to 2022, earned premiums in the South Carolina liquor liability insurance market more than doubled to $17.0 million from $7.6 million.

This dramatic surge in premiums can be attributed to various factors, but rising insurance rates play a crucial role, the report noted.

Profitability Crisis in South Carolina

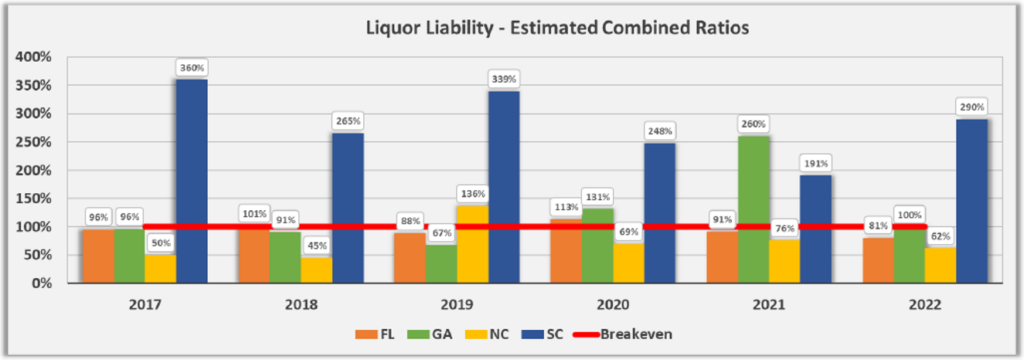

Since 2017, liquor liability insurers have lost about $1.77 for every $1.00 of premium earned over the six years observed. In the best performing of those six years (2018), the industry lost roughly $0.91 per $1.00 of premiums earned, while losing about $2.60 per $1.00 of premiums earned in the worst performing year, 2022.

“Combined ratios for the industry make it clear that this sub-line of insurance is being written at massive underwriting losses,” the report’s authors stated.

The severity of South Carolina’s liquor liability insurance crisis becomes even more apparent when compared to their neighboring states, where these same insurers have realized a net profit over time, the report noted.

Over the same 2017-2022 period analyzed, for example, North Carolina’s estimated liquor liability combined ratio ranged between 45% and 76%. In 2022, when South Carolina’s estimated combined ratio hit 290%, North Carolina’s stood at 62%.

Claims Severity and Frequency

The liquor liability insurance market in South Carolina also has experienced significant fluctuations in claim severity over recent years. In 2022, the average incurred claim per $1 million of earned premium reached $281,071, a substantial increase from $121,761 the previous year. This figure, however, falls within a broader historical context of volatility. The state witnessed its highest average claim of $338,244 in 2017, followed by a dramatic drop to $121,761 in 2021.

Despite these fluctuations, recent data suggests that South Carolina’s claim severity is aligning more closely with neighboring states in recent years, according to the report.

While severity trends show signs of alignment with regional norms, claim frequency in South Carolina presents a more pressing challenge.

From 2019 to 2022, South Carolina’s claim frequency (number of incurred claims per $1 million of earned premium) has outpaced that observed in the other states considerably. The claims frequency rate was nine in 2022, 13 in 2021, 10 in 2020 and 12 in 2019. During that same period, none of its neighboring states — Florida, Georgia and North Carolina — reported a claims frequency rate higher than five.

View the full South Carolina report here.

[ad_2]

Source link